File For Bankruptcy Things To Know Before You Buy

Table of ContentsBankrupt Melbourne Can Be Fun For AnyoneBankruptcy Australia - An Overview5 Simple Techniques For Bankruptcy MelbourneLittle Known Facts About File For Bankruptcy.8 Simple Techniques For Insolvency Melbourne

You'll after that have time to deal with the court and your lenders to determine the next steps. Will I Lose My Building? What happens to your property relies on whether you file phase 7 or phase 13 insolvency. If you're uncertain which choice is best for your situation, see "Personal bankruptcy: Chapter 7 vs.Phase 7Chapter 7 insolvency is commonly called liquidation bankruptcy because you will likely need to sell several of your properties to please a minimum of a part of what you owe. That stated, state regulations figure out that some possessions, such as your pension, residence and automobile, are exempt from liquidation.

The Ultimate Guide To Bankruptcy

Chapter 13With a phase 13 bankruptcy, you do not require to fret about needing to liquidate any one of your home to please your debts. Rather, your debts will be rearranged to ensure that you can pay them off partly or in full over the next three to 5 years. Remember, though, that if you don't follow the layaway plan, your financial institutions might be able to go after your assets to satisfy your financial obligations.

That stated, the 2 types of personal bankruptcy aren't treated the exact same method. While phase 13 insolvency is likewise not ideal from a credit report viewpoint, its arrangement is watched even more favorably due to the fact that you are still paying off at the very least some of your debt, and it will certainly continue to be on your credit history report for up to 7 years. Liquidation Melbourne.

There are some loan providers, however, that especially collaborate with individuals that have undergone personal bankruptcy or various other hard credit report events, so your options aren't entirely gone. Also, the credit history designs prefer new info over old details. With positive credit history habits post-bankruptcy, your credit scores score can recuperate over time, even while the personal bankruptcy is still on your credit scores report.

The 8-Second Trick For Bankruptcy

Bankruptcy proceedings are submitted in a system called Public Access to Court Electronic Records, or PACER for short. Generally, it's more typical for attorneys as well as financial institutions to use this system to seek out information concerning your insolvency. However any person can sign up as well as check if they want to.

This service is entirely complimentary and can enhance your credit rating quick by utilizing your very own positive repayment background. It can also assist those with poor or restricted credit history situations. Other services such as credit rating repair work might cost you as much as thousands and also only help get rid of mistakes from your credit rating report.

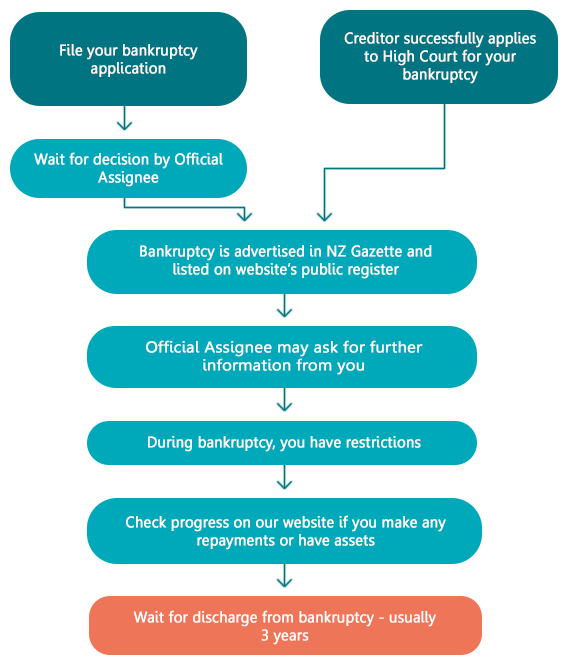

Bankruptcy is a lawful procedure where somebody who can not pay their financial debts can get remedy for a commitment to pay some or every one of their financial obligations. You need to obtain assist from a monetary therapy service and also lawful guidance before obtaining personal bankruptcy. Becoming insolvent has serious consequences as well as there might be various other choices readily available to you.

Top Guidelines Of Bankruptcy Victoria

AFSA has information about your responsibilities while bankrupt. There are serious consequences to ending up being bankrupt, consisting of: your insolvency being completely recorded on the your personal bankruptcy Homepage being noted on your look at this web-site credit rating record for 5 years any type of assets, which are not shielded, perhaps being offered not having the ability to take a trip overseas without the created approval of the bankruptcy trustee not having the ability to hold the setting of a supervisor of a company not being able to hold particular public settings being limited or prevented from continuing in some trades or professions your capability to obtain cash or acquire points on credit being impacted your ability to get rental holiday accommodation your ability to obtain some insurance policy agreements your capacity to access some solutions such as utilities and telecommunication services.

You're enabled to maintain some properties when you become bankrupt (Bankruptcy).

It is really essential to obtain lawful guidance before filing for bankruptcy if you possess a house. Financial obligations you should pay no matter of personal bankruptcy You will still have to pay some financial obligations also though you have come to be bankrupt.

Some Of Liquidation Melbourne

These consist of: court enforced penalties as well as penalties upkeep financial debts (consisting of youngster assistance debts) student assistance or supplement lendings (HELP Higher Education Loan Program, HECS Higher Education Payment Scheme, SFSS Pupil Financial Supplement System) debts you incur after you become insolvent unliquidated financial obligations (eg vehicle mishaps) where the amount payable for the damages hasn't been taken care of before the date of bankruptcythere the original source are some exceptions debts incurred by scams financial debts you're reliant pay as a result of misbehavior (eg compensation for injury) where the quantity to be paid has actually not yet been repaired (unliquidated damages)there are some exemptions to this.

It matters not if you're insolvent at the beginning or come to be bankrupt during the situation. You must tell the court, and everybody associated with your case if you're bankrupt or in a personal insolvency arrangement. You must likewise tell your personal bankruptcy trustee if you're included in any kind of property or spousal maintenance situations.

Telecommunications Industry Ombudsman (TIO) provides totally free alternative disagreement resolution scheme for unresolved problems concerning telephone or net services.